A Review of Us Tariff Rate Quotas for Beef Imports

A Review of U.S. Tariff Rate Quotas for Beef Imports

Printer-Friendly PDF

The United states is the world's largest producer of beef but it also imports more beef than any other land. U.Southward. producers specialize in raising high-value, grain-fed cattle, while the beefiness the Usa imports from other countries is mainly lower-value, grass-fed, lean product that is processed into footing beef. Overall, imports accounted for nearly fourteen percentage of U.S. beef supplies in 2015.

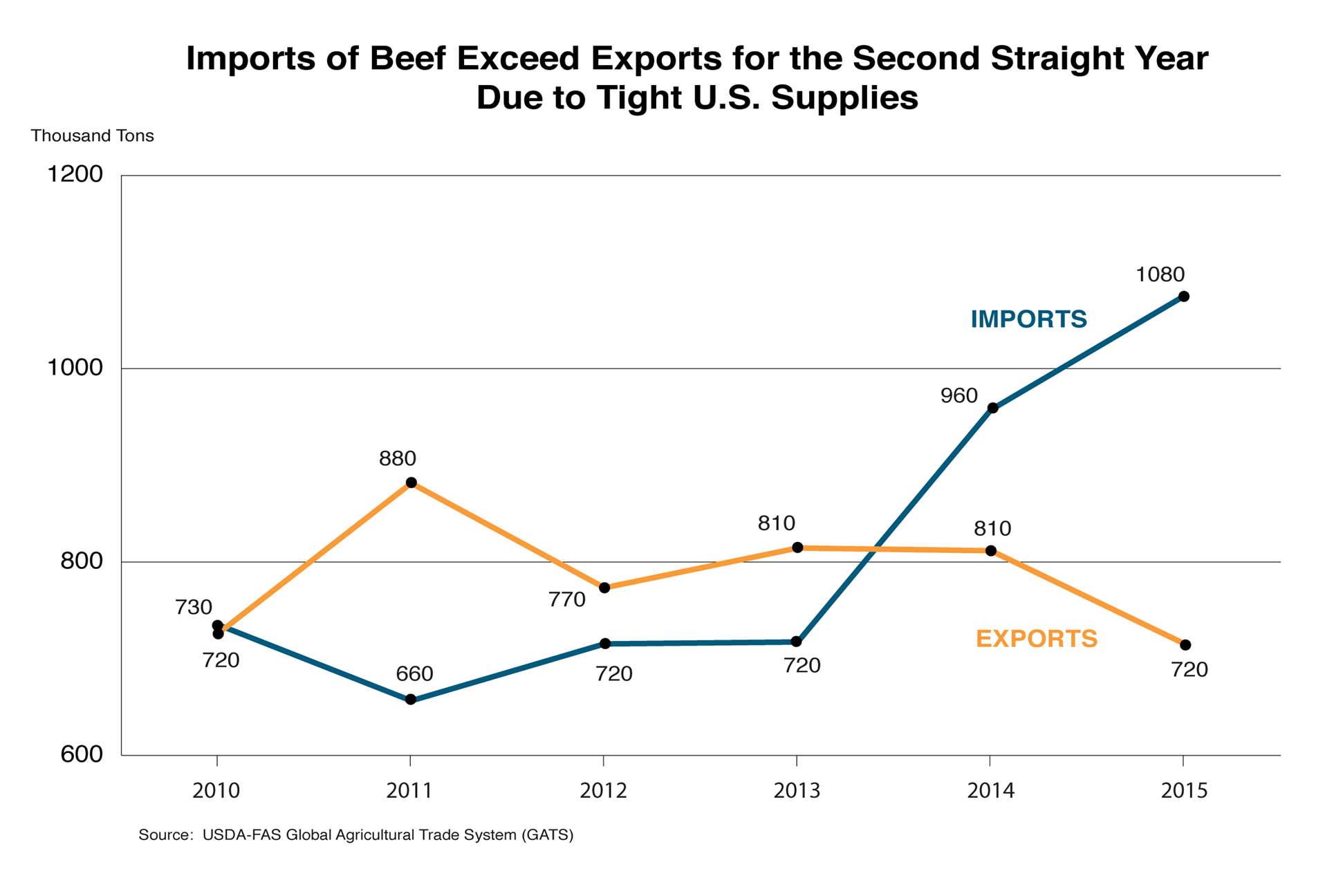

From 2011-2013, the The states was a internet exporter of beef on a volume basis. Notwithstanding, imports surpassed exports in 2014 when domestic production declined nearly half dozen per centum. Falling production was triggered by severe drought in the Southern Plains states, every bit well as high feed prices that caused farmers to reduce their herds between 2009 and 2014. Reductions in the cow inventory led to lower production of lean (non-grain-fed) beef, increasing demand for lean processing meat. Rising imports of both processing beef and table cuts through 2015 have start some, but not all, of the lower production. Expansion in the cattle sector began in 2014, spurred past high cattle prices and improved fodder weather in late 2014. U.Southward. beef production is forecast to increase in 2016 and lessen need for imported beef.

U.S. beef imports totaled $6.ii billion (1.1 million tons production weight) in 2015 and exports totaled $v.2 billion (716,000 tons). The gap between imports and exports is expected to narrow in 2016 as higher U.S. beefiness supplies support increased exports and decreased imports.

Tiptop Suppliers of Imported Beef

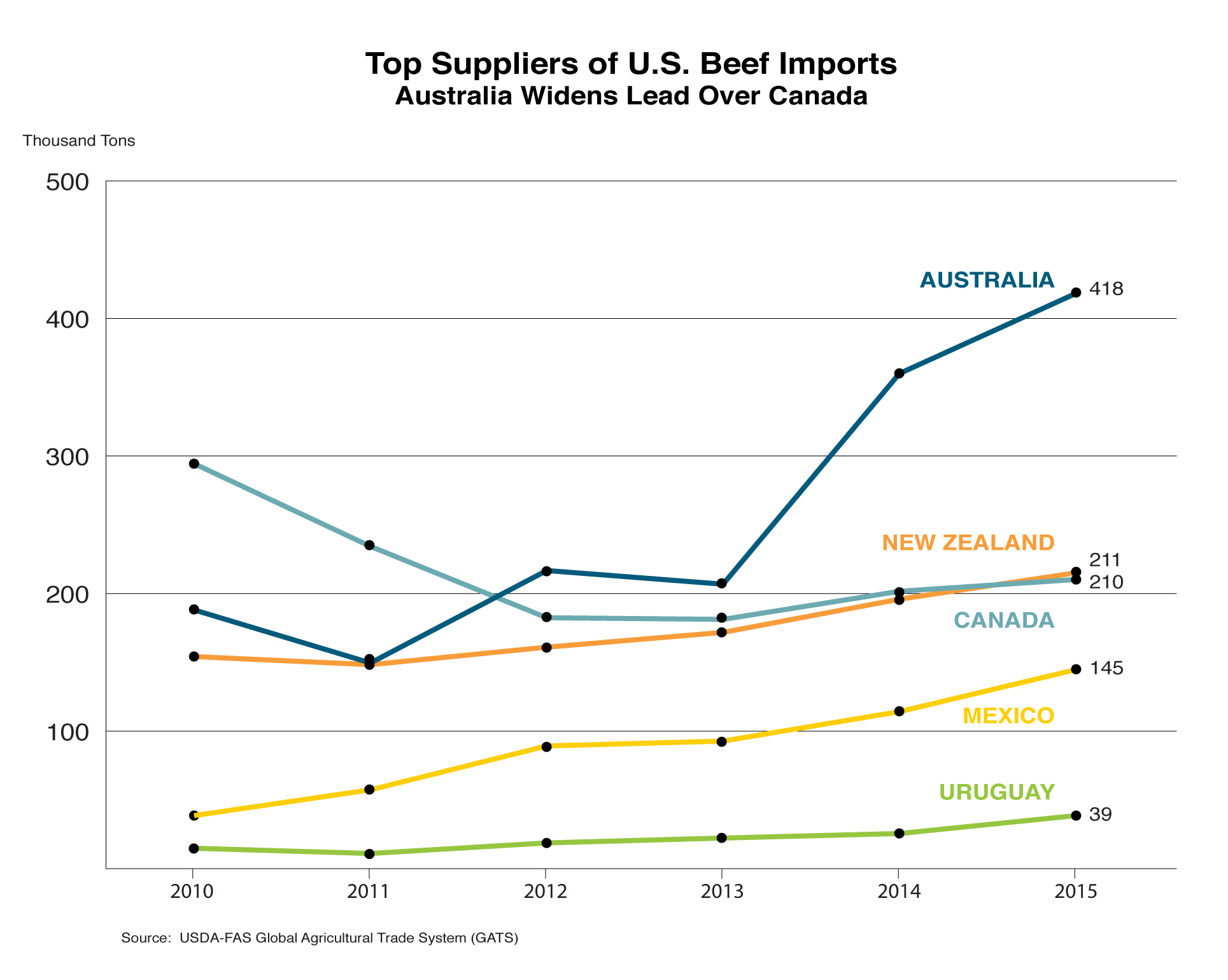

Australia was the leading supplier of U.S. beef imports in 2014 and 2015, while Canada and New Zealand were a afar 2d and 3rd. Shipments from Commonwealth of australia and New Zealand are composed primarily of frozen boneless beef for processing, while shipments from Canada and Mexico are typically college-value, fresh or chilled beef sold as cuts.

Germ-free Requirements for U.South. Beefiness Imports

For importers of beef to the United States, obtaining market access is a multi-footstep process. Countries must beginning exist approved by the U.S. Section of Agriculture (USDA) Animal and Plant Wellness Inspection Service (APHIS) based on fauna disease condition. APHIS assesses the risks of introducing beast diseases every bit a consequence of trade. In addition, the USDA Food Safety and Inspection Service (FSIS) must certify that the importing country'southward food regulatory system employs sanitary measures equivalent to U.S. standards. Currently, 12 countries are eligible to transport fresh or frozen beef to the United states of america: Australia, Canada, Chile, Costa Rica, Honduras, Ireland, Japan, Lithuania, Mexico, New Zealand, Nicaragua, and Uruguay.

U.S. World Trade Organization Tariff Rate Quotas

As a result of the 1995 Earth Trade Organization (WTO) Uruguay Round Agreement, the United States adopted a system of tariff rate quotas (TRQs) for imports of beef. The two-tiered system allows a specified volume of imports per calendar year at a lower rate of duty and assigns a higher tariff rate to volumes to a higher place the quota. Two types of U.Southward. TRQs were established through WTO negotiations:

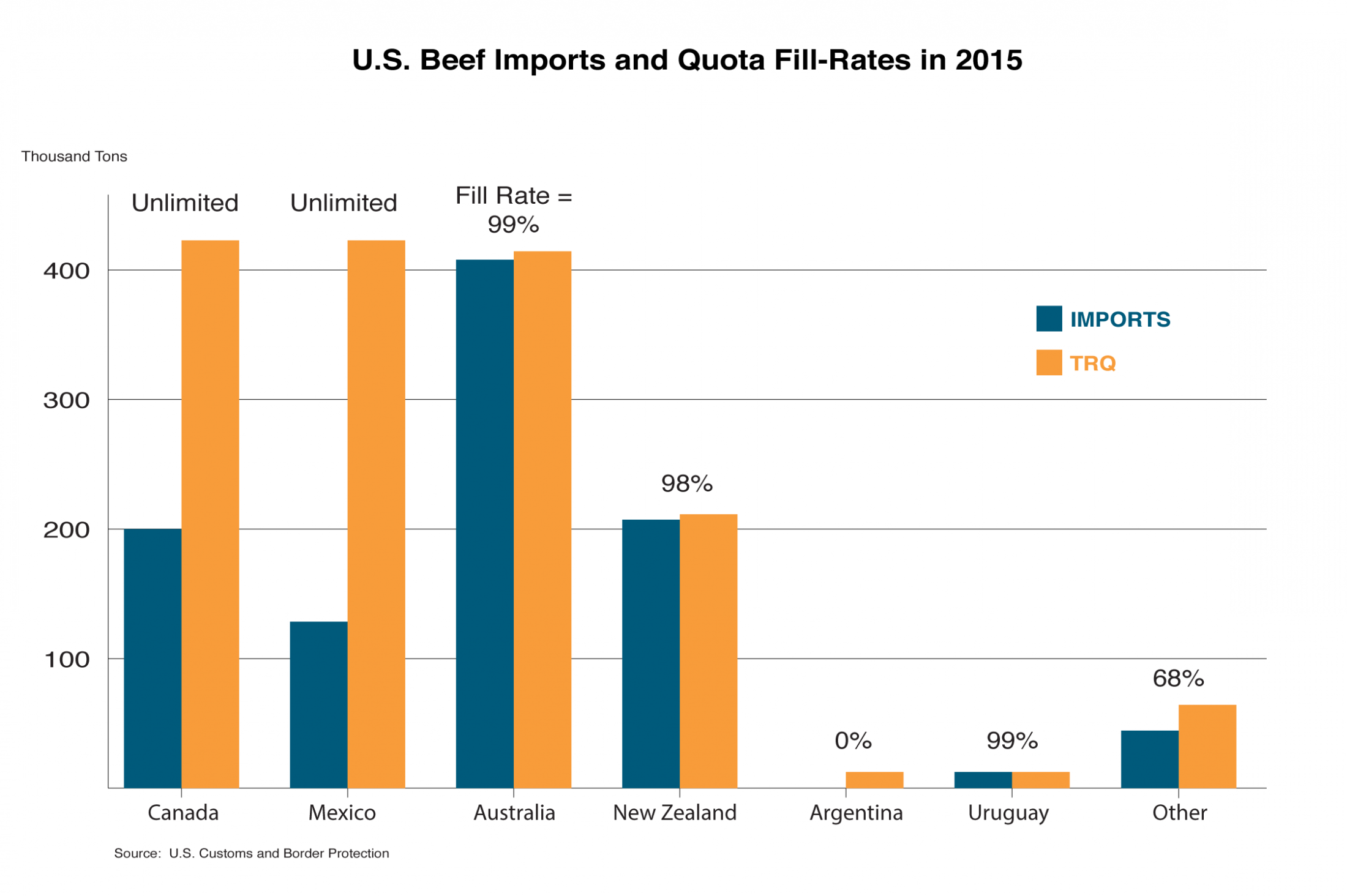

- Land-Specific TRQs: Created for Australia, Japan, New Zealand, Uruguay, and Argentine republic (see table).

- Other Countries TRQ: Provides preferential-duty access for other countries that are eligible to ship beef to the United States.

| U.S. Tariff Rate Quotas and Imports of Beefiness in 2015 | ||||||

| Country | U.S. Importsone | Tariff-rate Quota | Quota Fill up-Charge per unit | Charge per unit of Duty | ||

| Tons | One thousand thousand US | Tons | In-Quota | Above-Quota | ||

| Canada | 199,190 | $1,102 | Unlimited | N/A | 0% | N/A |

| United mexican states | 136,104 | $1,002 | Unlimited | N/A | 0% | N/A |

| TRQ countries | ||||||

| Argentina | 0 | $0 | xx,000 | 0% | 4.iv cents/kg | 26.4% |

| Commonwealth of australia 2 | 412,203 | $2,469 | 418,214 | 99% | 0% | 21.1% |

| Japan | 183 | $15 | 200 | 92% | four.4 cents/kg | 26.iv% |

| New Zealand | 209,768 | $one,163 | 213,402 | 98% | iv.4 cents/kg | 26.4% |

| Uruguay | 19,760 | $238 | 20,000 | 99% | 4.4 cents/kg | 26.4% |

| Other iii | 44,362 | $240 | 64,805 | 68% | 4.4 cents/kg | 26.4% |

| Total TRQs | 686,276 | $6,227 | 736,621 | 93% | ||

| 1 Imports include fresh/chilled and frozen beef only. Prepared and processed products are non subject to TRQs. Volumes are published past Customs and Border Protection, value is published by U.Southward. Census Bureau. | ||||||

| 2 Australia's full TRQ includes a WTO quota of 378,214 plus an FTA quota of xl,000 tons. Excludes iv,000 tons at reduced tariff. | ||||||

| 3 Open to other countries that do not take a land-specific quota. | ||||||

| Sources: U.S. Customs and Border Protection; FAS Global Agricultural Trade System; U.S. International Merchandise Commission Harmonized Tariff Schedule 2015. | ||||||

Free Trade Agreement TRQs

TRQs are also created via free trade agreements (FTAs), in which instance they are typically established equally a transitional footstep towards duty-free access. The following agreements expanded beef market admission into the U.s.:

NAFTA: As of Jan 2008, the Due north American Free Trade Agreement (NAFTA) was fully implemented, resulting in duty-free and unlimited access for beefiness amid the Usa, Canada and United mexican states. Canada and Mexico are among the elevation suppliers of U.S. beef imports, bookkeeping for about a third of shipments in 2015.

Australia: Australia received boosted quota access in its 2005 FTA with the United States adding to its WTO quota of 378,214 tons. The understanding allowed supplemental duty-gratuitous access of 15,000 tons in the second year afterwards enactment with a further 5,000 tons added annually or biannually. An additional quota with a reduced duty rate of 21 percent allows 3,500 tons in the first year, rise to 7,000 tons in 2022. In 2015 and 2016, total duty-free quota access is 418,214 tons, with a further iv,000 tons at reduced-duty. Unlimited duty-free admission begins in 2023.

CAFTA-DR: The 2004 Dominican Republic-Central America FTA (CAFTA-DR) established preferential quotas for each of the six parties: Costa Rica, the Dominican Republic, El Salvador, Guatemala, Republic of honduras, and Nicaragua (come across table). TRQs are contingent on filling of the WTO "Other Countries" quota – currently available to Costa Rica, Republic of honduras, and Nicaragua – which has yet to happen. Currently, those iii countries are eligible to ship beef to the The states, and shipments totaled $229 meg in 2015. Since the agreement was signed, U.Due south. beef imports from CAFTA-DR countries accept risen, totaling more than 45,000 tons in 2015. In 2020, CAFTA-DR countries will have duty-free unlimited access to the U.S. market place.

| CAFTA-DR Tariff Rate Quotas | |||

| Partners | 2015 U.S. Beef Imports | FTA TRQs (2016) | |

| Million United states of america | Tons | Tons | |

| Costa rica | $46 | 9,234 | 15,556 |

| Dominican Republic | $0 | 0 | two,520 |

| El salvador | $0 | 0 | 155 |

| Guatemala | $0 | 0 | 0 |

| Honduras | $6 | 1,140 | 775 |

| Nicaragua | $177 | 34,883 | 15,500 |

| Total | $229 | 45,256 | 34,506 |

| Sources: FAS Global Agricultural Merchandise System; U.South. International Merchandise Commission Harmonized Tariff Schedule, 2015 | |||

Other FTAs: Access has also been extended to the following countries through their respective FTAs with the United States: Bahrain, Chile, Republic of colombia, Jordan, Morocco, Oman, Panama, and Singapore. TRQs are granted during the initial catamenia of implementation and become unlimited at total implementation. At this time, only Chile is currently eligible to send beef to the United States.

| Beef Access from Gratis Trade Agreements | |||

| Partner | 2016 FTA TRQs | First Year of Implementation | Total Implementation (Unlimited Access) |

| Bahrain | Unlimited | 2006 | 2015 |

| Chile | Unlimited | 2004 | 2007 |

| Colombia | 6,381 | 2012 | 2021 |

| Morocco | 22,204 | 2006 | 2020 |

| Oman | 29,231 | 2009 | 2018 |

| Panama | 483 | 2012 | 2026 |

| Singapore | Unlimited | 2004 | 2013 |

| Sources: FAS Global Agronomical Merchandise Organization; U.S. International Merchandise Committee Harmonized Tariff Schedule 2015 | |||

WTO "Other Countries" TRQ

Eligible countries without a country-specific quota can access the "Other Countries" TRQ of 64,805 tons. Currently, five countries (Republic of costa rica, Honduras, Ireland, Lithuania, and Nicaragua) can use the quota, which provides a preferential duty rate of iv.4 cents per kilogram. Imports above 64,508 tons are charged the full tariff of 26.4 percent ad valorem.

In 2015, the Other Countries TRQ reached a fill up-rate of only 68 percent for the six eligible countries (encounter figure), despite potent U.S. import need. The fill-rate has climbed over the past 10 years from a low of 45 percent in 2005 to a high of 94 percent in 2011. Once the WTO quota fills, country-specific TRQs from enacted FTAs volition take event, allowing an boosted 34,506 tons for CAFTA-DR countries. As agreements are fully implemented, FTA partners will receive unlimited access, reducing pressure on the Other Countries TRQ.

Quota Allocation

The United States does not arbitrate in quota allocation; rather this is at the discretion of the exporting countries. For example, some countries distribute licenses to exporters. Australia maintains a system by which the quota is filled on a first-come, showtime-served basis until reaching a make full-rate of 85 per centum. The remaining 15 percent is allocated based on historical quota use . The Other Countries TRQ is offered on a first-come, first-served basis to the eligible countries.

Future U.South. Marketplace Access

If additional countries receive APHIS and FSIS approving to ship fresh/frozen beefiness, competition for the Other Countries TRQ is likely to accelerate, at to the lowest degree in the short-term. Under the current scenario, when a new country becomes eligible, imports could either displace shipments from other countries or be imported at the above-quota tariff charge per unit. After 2020, competition by existing countries for this TRQ will lessen as CAFTA-DR is fully implemented. Nicaragua, which accounted for nearly 80 pct of quota use in 2015, will have unlimited access, creating opportunities for other shippers. Farther quota expansion could be obtained through futurity WTO negotiations or future FTAs.

i Beef imports include fresh, chilled and frozen muscle cuts under HS headings 0201 and 0202 and exclude processed and prepared products which are non field of study to U.Due south. tariff rate quotas.

ii For more information on requirements, see http://www.fsis.usda.gov/wps/portal/fsis/topics/international-diplomacy/importing-products.

iii For more than information on Australia'due south quota allocation organisation, please see: http://www.agriculture.gov.au/SiteCollectionDocuments/ag-food/quota/red-meat/2014/the states-beef-2014-guild.pdf

boucicaulthato1970.blogspot.com

Source: https://www.fas.usda.gov/data/review-us-tariff-rate-quotas-beef-imports